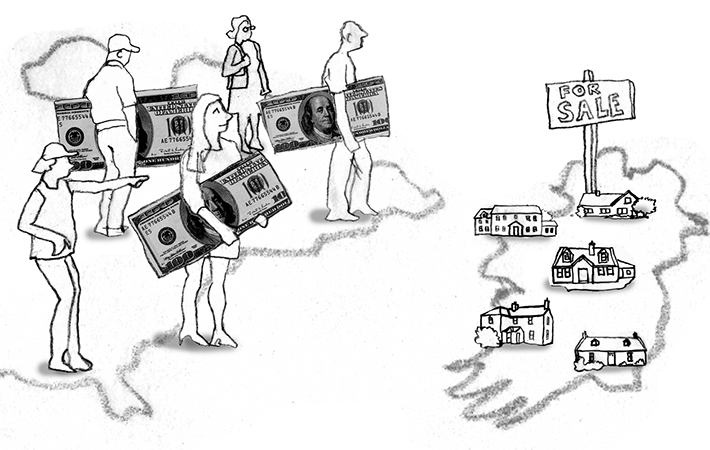

Many Malaysians are tempted to invest in properties abroad due to the higher yield they can earn from an overseas investment. For instance, Singapore, United Kingdom, Vietnam and Australia are just some of the popular destinations for Malaysian investors today. So, when buying a property overseas do you consider seeking financial advice, surveying the market and researching the procedures all by yourself? Or do you consider seeking the advice of a professional real estate agent to make things easier?

Buying Property Overseas: Do-It-Yourself or Find An Agent? Click To TweetIf you decide to research and take this on yourself without the help of an agent, here are some of the key questions you should be researching:

- What are the types of properties available to me?

It is especially common for governments in Southeast Asia to impose restrictions on foreign ownership of local properties in order to prevent dilution of local share and control property inflation. Some countries restrict foreign buying and selling in the primary market while some may have restrictions on secondary market. Sometimes, it is better to purchase properties via a company if it is deemed to add value to the economy of the country.

- How many years are remaining on the lease of the property?

In Malaysia properties often come with a 99 years lease period or even unlimited period, but this may not be the case when buying foreign properties. Several countries put a cap on the maximum lease period foreigners can get by purchasing a property. Therefore, make it a habit to ask for the remaining lease period whenever you buy property in foreign countries. - What are the tax rules and regulations to look out for both here and abroad?

The taxes collected by the government may come in different forms, be it tax levied when buying the property, tax levied when renting out the property, capital gain tax, property tax during occupation period, or stamp duties. These taxes are often designed to curb speculation behaviour. - Are you buying from the rightful owner?

Imagine buying a property from a fake owner and this person takes your money and runs away. Take it seriously. It could change your entire fate if you engage a qualified lawyer to assist you in clarifying the ownership status. - Is the political environment stable?

There are certainly many political variables that you need to take into consideration. For example, has the country changed its ruling party frequently over a short span of time? A change in government may not be a good news for investors because it might translate to changes in regulatory framework. Protest, anti-foreigners campaigns and strikes are all factors which discourage foreign capital investment and you might eventually throw in the towel on your property investment with low return. - How much loss would I suffer from movements in exchange rate?

A currency’s exchange rate fluctuates from time to time. We congratulate on your good fortune if the odds are in your favour. Nevertheless, should you rent out or sell the property, the foreign exchange risks would persist over time and you might not receive the desired amount of income based on your expected exchange rate. - How high is the yield/return?

The net rental yield is derived by dividing annual rental income (excluding any expenses involved) by the purchase price. Looking at the formula, a high purchase price may erode the yield even if your rental income is high enough and conversely, a low purchase price may be offset by a low rental income. The situation is similar if you are merely looking for gain in price and sell off after a fixed period of time. The net return is simply calculated by dividing your profit (excluding any expenses involved) by the purchase price.

The higher the price you buy, the lower the potential of price appreciation. Again, the lower the price you buy, the more you should question whether the price is likely to increase anytime soon.

Nevertheless, yield (return) may go far beyond the textbook’s formula. The equation of yield/ return could include everything: political stability, economic growth, supply and demand, market sentiment and so on. - What is the legal process before buying property?

Some countries may require home safety survey inspections on the property before loan financing is made. Some may require special certificates and contracts. Unfortunately, you are obliged to pay for these legal processes. - Does your visa status restrict you from staying in the country?

It’s largely fine if you are holding the property as an investment since it mostly does not require a long term visa status. However, if you are not a citizen nor a permanent resident and you intend to stay or retire in the country, you might need to follow additional measures to extend your visa long term. - How large is the buying volume and the price movement?

Take a close look on the recent housing trend in the area. Though you may not find an accurate valuation, at least you can take a glimpse of the price movement and understand market trends. Intuitively, you would not want to buy property in an area where home units are oversupplied or many homeowners are winding up their properties. Besides, several countries may have short term stimulus packages such as discounted visa, reduced legal fees or increased foreigners’ quota but these packages to attract foreign interest in local properties may be overthrown later. So, always check the history of these packages if necessary to prevent yourself from plunging into troubles. - Are you caught in a fake campaign?

Beware of the campaign slogan such as “guaranteed 20% return”, “hottest property investment with unlimited upside potential” or “world class investment opportunity”. Some may be scams and some may be a call to buyers who would buy at a staggering high price. Therefore, doing your own research is important to make sure that every detail in the campaign is correct. - Where can you get your mortgage loan?

You might probably find it hard to finance your property since many local banks in Malaysia do not finance foreign property. Even if you contact banks in Malaysia which have offices in the countries concerned, technically you will still be borrowing overseas. During loan negotiation processes, many terms and conditions may be less favourable for foreigners because those banks do not understand your payment history as good as local banks do.

Is doing everything yourself risky?

Yes, if you are not familiar with the process at first. You might have read the outdated policy, interpreted the policy differently, bought a wrong property in a ghost town, or overlooked the additional legal process. If you have committed any mistake stated above, your investment will be at stake and it’s not a small amount after all.

How about finding a professional agent?

You can literally skip the steps above because professional real estate agents are available here in Malaysia to help you. It’s easier if you engage a licensed agent who sells overseas properties because he/she will give you proper guidance on any legal procedures and paperwork submission. In addition to that, you can leverage on agents’ pricing experience to know whether your property is overpriced or underpriced.

There are a wide range of Real Estate Agents in Malaysia today who specialise in Overseas property investments so before you decide on which route to take it is worth contacting a few for a free consultation and also for a price.

Conclusion

We have heard about many real estate scams. To avoid this, you are encouraged to do your own research even if you are hiring a professional agent. Regardless of the ways you adopt, bear in mind that wherever you take your money to, bring along your own set of principle in order to keep your money safe.

–LOANSTREET