Before you get excited and want to starting your property investment journey, let’s find out whether you have the characteristics that the successful property investors have. Prepare and take a deep breath, let’s begin!

What Are The Characteristics Makes You To Become A Successful Property Investor? Click To TweetWhat Are The Characteristics Makes You To Become A Successful Property Investor?

➊ Millionaire Mindset

Ask yourself, do you have a millionaire mindset to push you to the success path? Before you discover your wealth in property investment field, business or any other investments, you have to develop your own millionaire mindset at first! In order to create massive wealth from any other fields, you must fist create wealth in your mind. Believe me, your mind is your treasure and this is the only thing that others can’t take away from you.

So, how can you develop a millionaire mindset like others successful people does? Here we telling you that, developing a millionaire/ successful mindset is just like developing muscle in your body. It can only be done if you have burning the desire to succeed and through incessant practice and discipline.

The way to develop a millionaire mindset is to regularly invest in yourself by attend seminars, reading books, seeking mentors, socializing and networking with like-minded individuals.

For this reason, I want to congratulate and thank you for reading this article. You have just put yourself far ahead of thousands of other property investors who fail to invest in themselves first, before starting their property investment journey.

➋ Start-up Capital

For beginners, it is advisable to have at least RM 80,000 to begin your property investment journey. You will need that money to pay for down payment of the property, stamp duties, legal fees, mortgage life insurance, minor renovations and reserve at least 3 to 6 months loan repayments in case your property have yet rent out to the tenants.

If you have not enough the basic capital, it is advisable to not to start yet. Only begin your property investment journey if you have meet the basic investment capital.

➌ Patience and Free Time

Property investing is a kind of business that will consume your time which will test your patience at the same time. It will takes a lot of time because;

➩ You have to find a good investment property to invest in. (usually will take approximately 1 to 6 month, depending on how much time and effort you put into it)

➩ Look for the good agents and solicitors who can work best for you. Besides, you will also need to take times to look for the better tenants to rent your property.

➩ Close the transaction. (You have to follow up from the time you pay for initial down payment till the time the property is legally transferred to your name)

If you are the person who is impatient and easily stressed out or lack of free time to do the above 3 things personally, then the property investing may not suit you.

➍ Good at Communication & Negotiation Skills

In property investment field, you have to deal with the people from different personality from all works or life from many different industries. You must have an excellent communication skills with Valuers, Bankers, Property Negotiators, Solicitors, Tenants, Sellers, Contractors, Developers and etc. In addition, you must have the basic understanding of their profession’s lingo in order for you to able to communicate easily and effectively with them. Apart from that, you must also have an excellent negotiation skills because almost everything in property investing is negotiable.

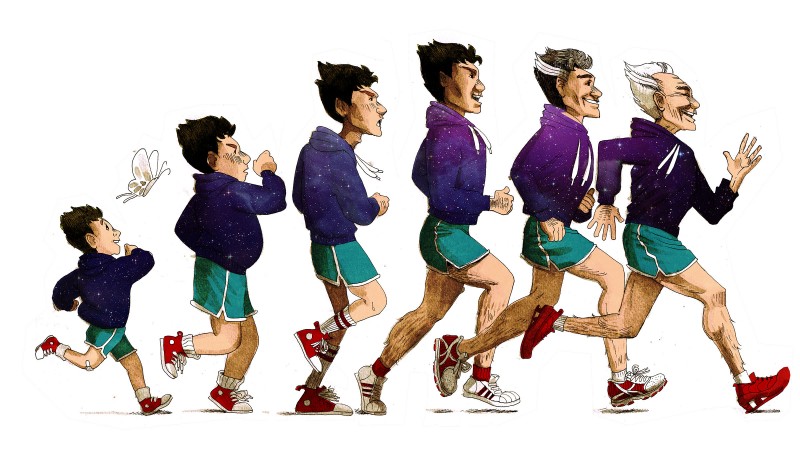

➎ Age-Wise

If you are young people aged below 30 years old, property investment is a great place to start your lifelong investing career, even before you start investing in unit trusts, stock markets or other investments. Property investing offers a well learning environment to develop your winning investment habits such as discipline, patient, research and so on.

The younger you start investing, the better it is. How much your properties will be worth in the future depends on the rate of return and time. (Do read: 8 Reasons Why You Should Buy House In Young Age)

On the other hand, if you are retiree or approaching retirement, you should buy properties with cash. This is because you are not qualify for banks loans for long tenures unless you are buying under a property holding company. If you invest in rental property, it’s rental income can fund your pension that can cover your living expenses and enjoy your retirement days and rest of your life with your loved one.

➏ Pick the Right Property Investment Strategy

In WMA Property Blog, you will find out there is many articles are talking about property investment strategies. Do visit out blog to discover all!

Your financial and emotional will determine which investment strategies will be suitable for you. For example, the skills required to succeed in residential properties are completely different from those required for commercial properties. In addition, the strategies, skills and mindset for investing in raw land are extremely different. Therefore, you have to find your own niche or investing style in property investments that suits your unique investment profile. (Do read: 7 Tips To Find A Right Property Investment Strategy)

Like this article or found it helpful? Share it!

Follow us on Twitter for more news, tips and inspiration. Become our mate on Facebook and explore our Pinterest boards.