To evaluate an investment property is not easy than you think. If you are new to the field of property investment, you should learn how to evaluate an investment property as well as determine whether this property investment is good to you. Propsocial will show you the guides with a step by step process of this topic;

Step By Step Guides For Evaluate An Investment Property Share on XHow to estimate the value of investment property?

➣ the value of a property depends on the potential income the property can generate, which is the annual rental income.

➣ one of the guidelines for banks and valuers to perform property valuation and for government to derive property tax as well, which includes quit rent and assessment fee.

Capitalisation rate

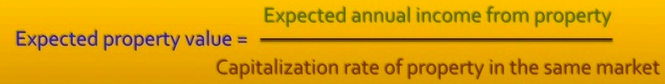

➣ A simple term used to estimate value of a property is rental yield. However, we call it capitalisation rate instead of rental yield when we talk about valuation.

➣ The formula is similar, i.e.

➣ To determine a property’s fair value, simply change a bit of the same equation:

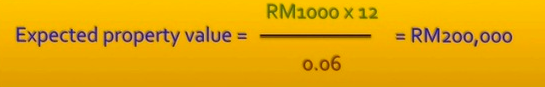

➣ For example, in Johor Bahru normally the capitalisation rate for rental apartment is around 6.0%-6.7%.

➣ This means that an investor purchasing a rental apartment in the area is expected to earn 6%-6.7% from his property.

➣ if you have an unit with average monthly rental income of RM1000 in the market, annual income will be RM12,000 (RM1000x12). From the equation, your property value should not be more than RM200,000, i.e. RM12,000/0.06.

➣ Capitalisation rate depends on the type and location of the property. You can easily estimate the capital rate for your property by asking the latest average rental income and selling prices in the same area from your property agents.

➣ Valuers and government get the data of market average rental and property prices for an area from the stamp duty records such as tenancy agreements, sell & purchase transactions of HASIL (Inland Revenue Board) and land office.

Net operating income multiplier

➣ Banks and other commercial mortgage lenders generally use the Net Operating Income (NOI) Multiplier in establishing property value for loan purposes.

➣ Net operating income is the income produced by a property after all operating expenses and allowances for vacancies have been deducted, but before mortgage payments.

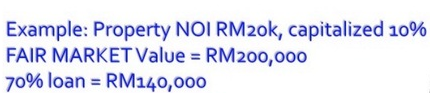

➣ An investor says, “I will not pay more than 10 times the net operating income.” When the property has an NOI of RM20,000 this investor is saying that the maximum price he would pay for is 10 times that or up to RM200,000 for the property.

➣ The accuracy of this formula lies in the fact that all the variables in the operation have been eliminated, namely rental income, vacancies and operating expenses.

➣ NOI is “capitalised” at a certain percent, say 10%, to establish a value for loan purposes.

➣ You can now see why an understanding of NOI is important to you. The amount of money bank lend to you practically based on the NOI Multiplier of the property.

➣ Estimate the value of investment property = Capitalisation Rate and Net Operating Income multiplier.

➣ Valuers and banks also estimate the value of a property and the amount of loan partly on these two formula.

Financial analysis of your property

➣ For example, you meet with Mr Seller, owner of the apartment that you want to invest. The price he wants isRM150,000. According to Mr. Seller, his apartment is currentlytenanted for RM1,100 every month, and he never has a vacancy. The seller is no doubt convinced that he is practically “giving” his property away at RM150,000 offering price. The apartment has to be worth much more than he is asking and he’ll probably have a long list of reason to prove it. These may include such things as:

– The 8th floor apartment unit in the same building sold last year for RM160,000.

– Due to inflation, his apartment has appreciated far more than the price he is asking.

– His rent is the lowest on the street. Next year, when you own the apartment you will be able to increase your gross income by at least 10%.

– Mr Seller can produce paid bills showing he spent over RM15,000 in renovation last year.➣ What he really means is that he likes his property, he is not overly motivated to sell and he wants to make as much profit as possible. As a practical matter, it is up to you to determine just how overpriced his property really is, if it is at all. Surprisingly, many sellers offer their property at a fair market value or below. You may want to remember this when you become the seller.

Here is the reason he may price it too low:

➣ Assume that Mr. Seller purchased the apartment eight years ago for RM80,000. The difference between RM80,000 and his RM150,000asking price is RM70,000. He will realize a RM70,000 profit for just sitting eight years and waiting. His property may really be worth much more!

Nowadays, most of the buyers though the sellers are markups the property price and started to negotiate with the seller. But, do they know the actual market price of the property itself?

Here is our advise, if you’re going to buy any investment property, do analyse how much that property worth in current market by yourself so that you can determine whether that property is overpriced or lower. If you know the seller is offering you the low price which compare with current market, you may just courtesy inform them the truth. By doing this, you will get the good reputation in this property investment field. Cheer!

Like this article or found it helpful? Share it!

Follow us on Twitter for more news, tips and inspiration. Become our mate on Facebook and explore our Pinterest boards.