Once an individual have a certain capital, he/she will start to looking for other opportunities to earn more money so that can increase their wealth. That is no doubts that property investment is their favorite choice to rolling their capital. Property investment is a long-term way for every individuals to obtain financial security for their present and future.

With property appreciation, every property investors can achieve good capital growth. In order to achieve good capital growth, here are important points to consider while investing in property;

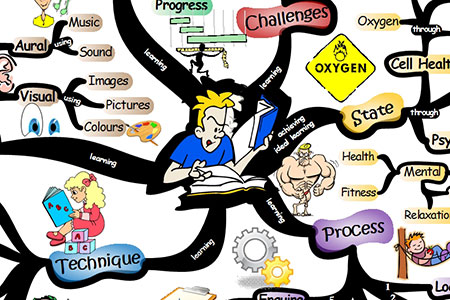

➊ The “rules” of property investment is to search out an affordable property that have potential appreciation in the near future. But how can you find that kind of property to invest in? Well, you can get the guides packed with useful information from variety of books, internet, property investment seminars and etc. The first step you need to do before buying an investment property is to increase your knowledge.

➋ But honestly, those huge amount of information will definitely make all the first-time property investors confusing. It is advisable to start from basic and then learn some strategies and tricks of the property trade.

For example, you can start out from how to buy a property at best possible price or even below market value. And, decide whether rent it out to earn monthly rents or sell it out at higher price. If you focus on rental income, you should learn more the strategies of how to find a good tenant, how to set a suitable rents and etc. If you focus on sell later, you should learn the renovation tips, how to find a potential buyers and etc.

➌ Although the property market is always changing, but property investment is still a viable which means that to improve your financial portfolio. With time moves on, as an example with new media options of television and internet, new trends in property investment are appearing.

➍ With the last decade, a traditional way of property flipping is to buy a property, fix the existing problems, do a little renovation works, put it up for sale and sell-off the property fast.

➎ According to your financial and investment portfolio, you will get to know whether you are suitable to invest in residential or commercial property investment. Besides of that, how can you define which one is best investment for you?

Residential property investment is the investment which carry minimal risks compare to commercial property investment. While the property investors who invest in commercial property will need to worry the economy changes and conditions of businesses. Besides of that, the other main concern of these both type of property investing is bank loans which is residential property easier to get the bank loan than commercial property.

Final Word

Regardless of investing in residential property or commercial property, every property investors have to consider the surrounding environment which can effect the resale price and rental. You can visit WMA Property to get more tips and guidelines of how to choose a good investment property.

It’s not about property ownership it’s about control! To get more details. Click Here!

Like this article or found it helpful? Share it!

Follow us on Twitter for more news, tips and inspiration. Become our mate on Facebook and explore our Pinterest boards.