PETALING JAYA: Hard statistics and anecdotal evidence suggest demand in the property market has continued to weaken, according to Maybank Investment Bank Research.

The firm also said reported loan default cases and the rise in the number of properties up for auction pointed to a challenging market environment.

“From our discussions with the bankers and industry players, there has been an increase in the number of properties put up for auction, while banks had reported of several isolated cases of small, unlisted property developers defaulting over the past year.”

The research house added that supply will continue to outstrip demand in the near term, especially when units, particularly high-rise launched under the 5/95 housing loan scheme between 2012-2013, come on stream.

“The latest statistics and findings from our discussions with bankers and industry players point to yet another challenging year for the property sector.

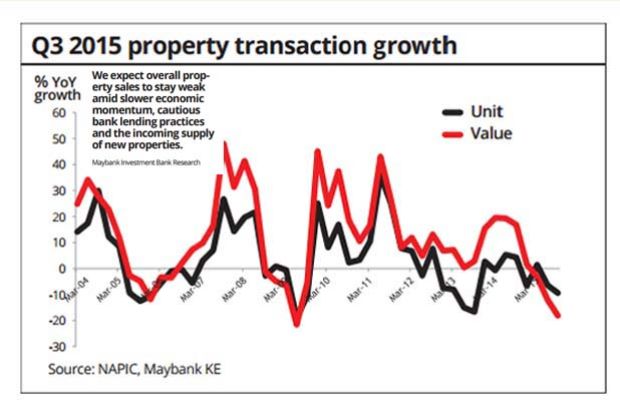

“We expect overall property sales to stay weak amid slower economic momentum, cautious bank lending practices and the incoming supply of new properties.”

Maybank said the number of unsold residential properties is likely to trend upwards over the short term particularly in Johor and Penang, in view of the high volume of new properties launches in from 2012 to 2014.

“Depending on location, it will take some time for demand to catch up with the impending supply of new properties.”

Citing statistics from the National Property Information Centre (Napic), Maybank said the country’s number of unsold residential properties was on the rise.

“The number of unsold properties increased by 6% quarter-on-quarter and 2% year-on-year in the third quarter of 2015, with the highest number of unsold stocks being in Johor (23%) and Selangor (18.6%).

“In the third quarter of 2015, the nation’s incoming supply jumped by +5% quarter-on-quarter, 18% year-on-year and we would expect it to rise further this year.”

The research house also highlighted that the Government’s various housing schemes point to the potential influx of affordable housing, which will pose competition to existing players.

“We think that developers may have underestimated the potential competition from the various government housing schemes.

“These housing schemes under the state and federal governments have created a large incoming supply of affordable housing in the country and this could pose strong competition to existing players especially when most developers are also focusing on the affordable housing segment now.”

Citing Skim Perumahan Rakyat 1Malaysia (PR1MA), Maybank said there were 227,776 units of approved PR1MA homes (priced between RM100,000 and RM400,000 for Malaysians with a monthly household income between RM2,500 and RM10,000.

Of these, it said, 66,869 units are now under construction (17% in Penang, followed by 16% in Kedah, 12% Perak, 8% Selangor and 7% in Johor).

“From our conversations with the mortgage financiers there, we understand that potential buyers of PR1MA home could borrow up to 110% margin of finance from the sale and purchase price, subject to their credit background checks.

“This compares against the typical 90% margin financing offered to private projects (for first and second residential property purchases, subject to credit background checks, type of projects and discounts/rebates offered by the developers).”

–THE STAR ONLINE