The Malaysian economy expanded by 4.9% y-o-y in Q2, the smallest growth since Q4 2013. The unemployment rate remained unchanged at 3.1%. The Ringgit recorded a year-to-date drop of 27% against the US dollar, driven by the devaluation of the Renminbi amid concerns on China’s economic growth, weakened investor sentiment, and low oil prices.

Investment activities remained strong, notwithstanding the uncertainties on the economic and political front that continue to plague the country and erode business confidence. Although overall bank lending continues to grow, the tightening of credit on the property sector is likely to deter deal flow.

Business sentiment was affected by increased local and external economic uncertainties, in particular, the attrition of the Oil and Gas sector. Significant supply pipelines continue to bear a cloud over occupancy and rental rates for office sector, which nevertheless remained stable for the quarter (Figure 1).

Weak consumer sentiments and the short-term effect of the implementation of the Goods and Services Tax (GST) had affected retail sales. The projected growth rate for retail sales in 2015 lowered for the fourth time, from 4.0% to 3.1%.

The uncertain market conditions resulted in weaker market sentiments, and developers are already revising their sale targets for next year, as well as re-strategizing their planned project launches.

ECONOMIC OVERVIEW

Malaysian economic growth slowed in Q2 2015

The Malaysian economy grew by 4.9% y-o-y in Q2 2015 (Q1 2015: 5.6%), the lowest growth recorded since Q4 2013 (Figure 2). On a q-o-q seasonally adjusted basis, the economy expanded by 1.1% in Q2, slightly lower than the 1.2% achieved in Q4 2014. This could be attributed to the slowdown in domestic demand and contraction in net exports.

The labour market remained stable, with an unemployment rate of 3.1%. Private domestic demand increased by 5.7% y-o-y in Q2, lower than the 9.6% registered in Q1, as private consumption and investments grew slower. The lower growth in private consumption also suggested that households have adjusted their spending patterns following the introduction of GST in April. Demand from the public sector merely grew by 0.9% y-o-y in Q2 (Q1 2015: 2.5%) due to the contraction in public investment.

All sectors expanded at a slower pace in Q2, with the exception of the agriculture sector, which turned around to achieve a positive y-o-y growth of 4.6%. The mining sector, which registered a y-o-y growth of 6.0%, was the leading driver in Q2, followed by the construction sector, which grew by 5.6% y-o-y.

Headline Inflation increases

The headline inflation rate, as measured by the Consumer Price Index (CPI), increased by 2.2% y-o-y in Q2, substantially higher than the 0.7% recorded in Q1 2015. This is in line with the expectation that the CPI will rise following the introduction of GST.

Consumer Sentiments Index hits six-year low

The Consumer Sentiments Index (CSI) continued to fall in Q2 2015 for the fourth consecutive quarter. The index decreased to a six-year low of 71.7 in Q2, from 72.6 in Q1 2015.

Ringgit weakened further in Q3

The ringgit slid further in Q3, falling to a 17-year low against the greenback. The continued fall was driven by the devaluation of the Yuan, and the weakening investor sentiment amid political uncertainty and the ongoing controversy on 1Malaysia Development Berhad (1MDB).

In Q3, the Ringgit recorded a double-digit drop of 17.4% against the US dollar. It also depreciated against the Pound Sterling (-13.3%), Euro (-18.2%), Australian Dollar (-7.3%), Japanese Yen (-19.8%) and Singapore Dollar (-11.0%).

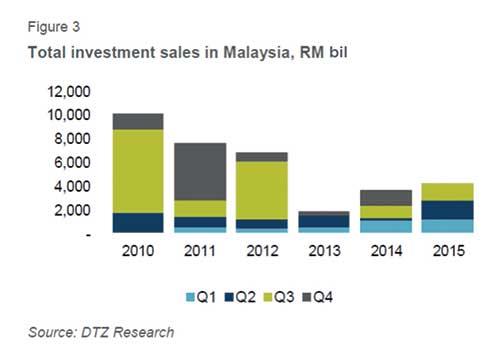

Investment

Stable investment activities despite concerns

Investment activities remained strong notwithstanding uncertainties on the economic and political front that continue to plague the country and erode business confidence. In the review period, the total investments recorded was relatively unchanged at about RM1.52 billion c.f., as compared to the RM1.55 billion in Q2.

REITs continue to grow in influence as a player in the investment market with the listing of a new REIT, Al Salam REIT, with a total asset value of RM903 million. They are sponsored by Damansara Asset Sdn Bhd and QSR, both being Johor state-linked entities. Commercial assets in Johor Bharu and a portfolio of restaurant assets across the country dominate most of their portfolio. The projected forward yield for 2016 across the portfolio is 6.41%. Despite the mixed quality of the portfolio, it was oversubscribed by 2.96 times.

Investment yield remains stable, and the overnight policy rate remained unchanged at 3.25% at its September meeting of Bank Negara Malaysia. The other major deal reported was the sale of Da: men for RM 488 million, a new mall to be completed this year for RM1,159 per sq ft. Equine Park Country Resort Sdn Bhd, a company linked to Datuk Desmond Lim, a major shareholder of the REIT, sold the mall to Pavilion REIT.

During the quarter, the retail sector was active with sellers as two other medium sized malls were reported to be for sale in the review period, namely Aeon Mahkota Cheras, of net lettable area of 211,495 sq ft and Seremban Prima, a newly refurbished mall in Seremban. With a retail sale dip in the making and a more competitive market in the future, pricing is the key to being able to attract a buyer.

During the quarter, there were several deals completed that were related party transactions. This includes the transfer of Imperia Office, Wisma AmanahRaya, and domestic players dominate most of the activities with foreign funds sidelined, due to the increase in country risk.

Credit tightening threatens future market deals

Although bank lending continues to grow, the tightening of credit by banks on the property sector is likely to put a brake on deal-making in the coming months, as banks become more risk adverse. Recent fractious political developments are a damper to overall sentiment beside a deteriorating business environment.

We expect a more cautious and a wait and see approach for investors as they sit on the sidelines until a clearer picture emerge. To provide more local support to the market, Government-linked entities are likely to liquidate their mature offshore investments and inject the funds to support both the ringgit as well as the domestic market.

The next few months will see lesser activity as the year winds down, and investors will start re-strategizing to navigate the headwinds ahead effectively.

Office

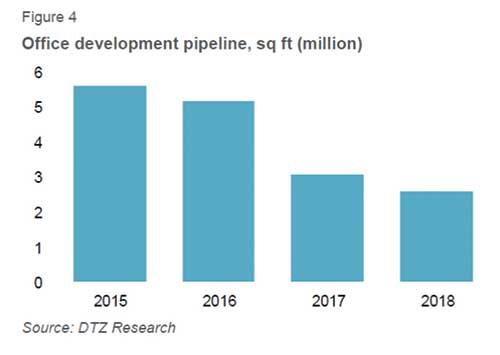

Only one office building completed for the quarter

In Q3 2015, the KL office market saw only one completion, i.e. Ilham Tower, at Persiaran KLCC (Jalan Binjai). Ilham Tower adds 426,000 sq ft of office space. The 58-storey is an integrated office and serviced apartment operated by Oakwood. The grade-A office has a reported monthly rent of RM7.5 to RM9.0 psf.

The considerably above-average rate is attributed to – among various others – its Greenmarket Gold Plus status, as well as being built with the quality near to the technological benchmark, MultiSuper Corridor Status. The dual-status has further become the market’s standard as landlords seek to retain tenants in current market conditions. Office units in Ilham Tower are located from the ground up to the 35th floor while the serviced apartments and other facilities are housed from 36th floor onwards.

With the addition of Ilham Tower, office supply in KL now stands at 75.7 million sq ft. More than 32 million sq ft of the supply is located within the Golden Triangle area. A few more office towers are expected to see completion in Q4, which will add about 2 million sq ft to the stock. These buildings include KL Trillion by Singaporean Sim Lian Group at Jalan Tun Razak, as well as two of the office towers in The Vertical development in Bangsar South (UOA Group).

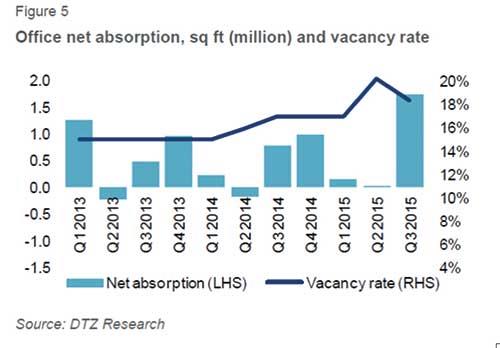

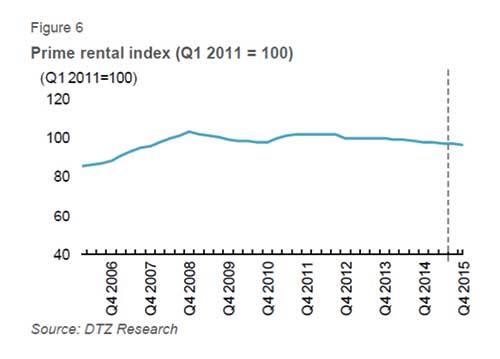

Stable capital value and rental despite declining occupancy

Average occupancy has seen a slight increase from 79.8% in Q2 to 81.6% in Q3. The increase was attributed to tenants moving into newer developments that came on board in Q2. These developments include Naza Tower @ Platinum Park at Persiaran KLCC, Q-Sentral at Jalan Sentral, and Summer Suites off Jalan Sultan Ismail. The largest of the three, Q-Sentral with about 1.4-million sq ft office space, was estimated to be 30% occupied thus far.

Rents and capital values remained generally stable. Two blocks of grade C office at Menara Pandan at the city fringe, in a residential neighbourhood of Pandan Indah, were sold for RM185 per sq ft, whilst Wisma Amanah Raya, a secondary office in the city centre was sold at RM507 per sq ft.

Office market is cooling down due to economic condition

Given the challenging economic climate, the office market is expected to soften. The restructuring and consolidation of banks and gas companies will lead to the higher vacancy rates.

Retail

Weakening consumer confidence

Consumer confidence fell further to 71.1 points in Q2 2015, from 72.6 points in Q1 2015. Consumers’ finances are experiencing deterioration due to generally higher prices and they are holding back on household spending.

According to the Retail Group Malaysia (RGM), the projected growth rate for retail sales in 2015 was lowered for the fourth time, from 4.0% to 3.1%. Consumers have tightened their spending since the end of 2014 ahead of GST. The retail sales in Q2 2015 plunged 11.9% as compared to a year ago, the lowest quarterly retail growth rate since Asian Financial Crises. For Q3 2015, the retail industry was expected by RGM to grow by 2.5%, however, Malaysian Retailers Association (MRA) was expecting only 0.1% sales growth. 6.0% sales growth is projected by RGM in Q4 2015 as the consumers will get used to the GST.

No completions in the quarter

No new retail malls were completed in Q3. The stock in Kuala Lumpur remained unchanged at 28.8 million sq ft and average occupancy rate was at 90.0%.

Going forward, approximately 3.0 million sq ft of retail space in both the city and suburban areas are expected to be completed in Q4 2015. This is expected to exert supply-side pressure on the vacancy rates of retail outlets. The upcoming retail malls are M3 Mall, Da Mén USJ, IKEA@Jalan Cochrane, Glo Damansara, Sunway Pyramid Phase 3 and Empire City (Table 2).

The entry of these new malls will see a tougher operating environment for all mall operators and downward pressure on rents amidst competition to attract retailers, particularly in the suburban neighbourhoods where most of the new malls are located. Correspondingly, retailers were also more cautious on their expansion plans and operational expenses.

Weakening ringgit leading to higher import cost

The US dollar to the Malaysian Ringgit hit over 4.42 for the first time since 1998. According to RGM, consumers can expect shopping to get more expensive in Q3 2015 as the weakening value of the ringgit will lead to a hike in retail prices due to higher import costs. In addition, the continuing political issues in the country negatively impact the local retail sector. The current political situation is affecting the Malaysian consumer sentiment level and buying mood.

Acquisition of Mall

Da Mén USJ mall was acquired by Pavilion REIT for RM488 million, from Equine Park Country Resort Sdn Bhd and Revenue Concept Sdn Bhd. The acquisition includes a five-storey shopping mall with a lower ground floor of about 420,920 sq ft of net lettable area as well as a two-level basement car park with 1,672 parking bays, analyzed at RM1,159 per sq ft with estimated potential yield of 6.8%. The mall is expected to open in November 2015. Pavilion REIT’s portfolio will increase from RM4.4 billion as at June 30 to RM4.9 billion with the acquisition.

Residential

No new supply during the quarter

No new supply was recorded for high-end condominiums in Q3, with only 2,814 units from 9 high-end condominium projects were completed since Q1 this year.

It is expected that the 5,125 units of a high-end condominium in the pipeline will come on board by the end of the year. Amongst major developments expected to be completed in Q4 are M City Residential Suites (1,118 units), Banyan Tree Residences (441 units), KL Trillion (320 units) and Le Nouvel KLCC (200 units) (Figure 8).

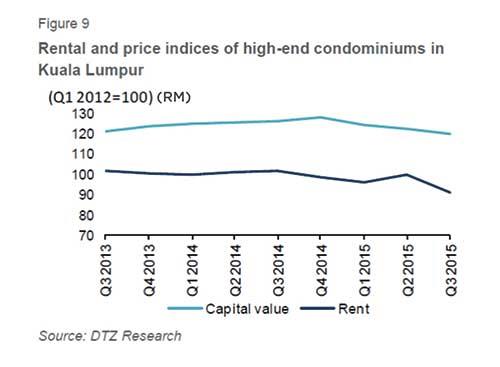

A stable market despite witnessed slight drops in both capital values

In Q3, the Kuala Lumpur high-end condominium market remained relatively stable, with the overall average price decreasing marginally by 2.0% q-o-q to RM723 per sq ft from RM738 per sq ft in Q2. While the residential market continued to be weighed down by weaker buying sentiments, the depreciation of the Ringgit since the beginning of the year helped make properties more affordable to foreign investors. However, the impact was muted by the exchange rate volatility. The pending completion of 5,000 units is expected to further exert greater downward pressure on prices.

The average rent for a high-end condominium also softened, declining by 8.8% q-o-q to RM3.23 per sq ft per month from RM3.55 per sq ft per month in Q2 (Figure 9). This was largely due to slower leasing demand, as the number of expatriates decreased with the consolidation of the Oil and Gas sector.

Uncertainty and challenging market ahead

Sales and new launches are expected to be sluggish, which further weakens market sentiment, especially for luxury properties. The softening of the market is expected to be compounded by downside risks from the external environment and lasting effects from the various cooling measures imposed. Additionally, the Malaysian Government is unlikely to shift its position on the cooling measures.

Developers are also revising sale targets, especially for next year, as well as re-strategizing their planned project launches to make them more appealing in the evolving environment, given that the market recovery may take a longer time. Longer soft launch periods will help developers manage risk and gauge underlying sentiment. This is especially so given the thin and diminishing high-end market. In contrast, there is a large demand from middle-income households that find the current offerings unaffordable.

DISCLAIMER: The data above represents the findings of DTZ Research and is not in any form and endorsement or recommendation by iProperty.com. Readers are encouraged to seek independent advice prior to making any investments.

— IPROPERTY