Investing in property can help yourself to generate residual income and enlarge your wealth. Some people can do well on their investment properties and even become millionaire or billionaire in this field. But, some people may seem not that way, even though they have did their best to managing their investment properties. Do you know why? With our experiences, they might using the investment strategies or tactics that doesn’t really suit them, failed to do a proper plan for their first investment property or jump in too fast without sufficient knowledge, hence they’re failed.

In fact, everyone have a chance to become millionaire or billionaire through property investment. All they have to do is invest in the right way, right time and with right strategies. Here are 5 top ways that you can learn how to generate passive income from investment properties.

➊ Buy the right property

This is very extremely absolutely definitely the most important step that you need to be very careful. Once you invest in the wrong property or wrong location, you can’t have your money back and you just let it join to your liabilities department. To know how to pick a perfect investment property? Follow these tips: 5 Simple Tips For New Property Investor

➋ Manage your properties

After buying the right property, the next step you need to do is manage it right. If you plan for make a property flip a flop, it can make a significant profit after selling it out. However, this strategy does not work so well in property investment sometimes. This is because that the time taken to buy and sell properties (due to the including legal and financing matters), which is usually takes up to 6 months. In this 6 months, you’ll earn nothing from this property, you’re even have to use your own money to pay for the loan installments.

On the other hand, if you plan to rent out this property, it is advisable to buy a ready-built property or ready-tenants. But you have to manage it right, and become a Millionaire Landlord. To know how to deal with tenants? Follow these guidelines: 8 Guidelines of Tenant Management

➌ Holding on your property

By holding on, you have to reduce the transaction costs such as legal fees, stamp duty, advertising, agent’s fees and other costs. These all costs can come up to a substantial amount, which will reduce your profits significantly.

Owning 1 to 2 properties can’t make you rich, you need to have at least 9 to 10 properties can only be a property millionaire. In short, you will win big by holding on to your propertiessssss.

➍ Trust yourself

Regardless of which investment that you choose to invest in, you have to find yourself a mentor. Come out with your investment portfolio and show it to your mentor, your mentor will explain to you the pros and cons and give you some advice.

Besides, you will have to also believe in your capabilities, your skills and yourself to succeed here. This is because you will made mistakes and fall in the difficult times. You have to get up and try over and over again. Everyone will make mistakes, not just only you. But the problem is, will you stand up, face the mistakes and solve these mistakes?

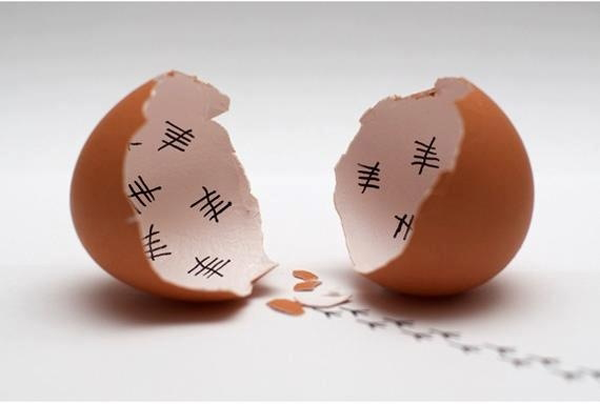

➎ Be Patience

Property investment can’t make you rich overnight, it need some time to run its profit. Unlike stock market investment, its price fluctuate on a daily basis or even minute. Especially you buy and hold, it takes more years to see the fruits of your labor. This calls for patience, tons and truckloads of it.

Bottom Line

You have to remember that properties are also one form of investment, which contain an element of risk, no matter how slight it is. However, if you following the right guides from WMA Property Blog may increase your chances and probability to making a big wealth. The more knowledge your have, the more chances you have of making that grand home run, and become next property millionaire. Good Luck.

It’s not about property ownership it’s about control! To get more details. Click Here!

Like this article or found it helpful? Share it!

Follow us on Twitter for more news, tips and inspiration. Become our mate on Facebook and explore our Pinterest boards.