Nowadays, most of the people are jump into the property investment field because it’s appreciated can help to create massive wealth for themselves. Well, if you’re invest in the right timing, right places and in the right ways, you will earn lot of money from either commercial property or residential property and you can also retire early with massive retirement funds.

In order to be success in this field, the first thing you should do is put your shield on to avoid any legal issues coming to you. Besides, there are many existing risks are waiting for you to step in. In today, we will talk about how to protect yourself in property investment field. Here are the protection you should have as follows;

Ⓐ Protect Yourself From Public Liability

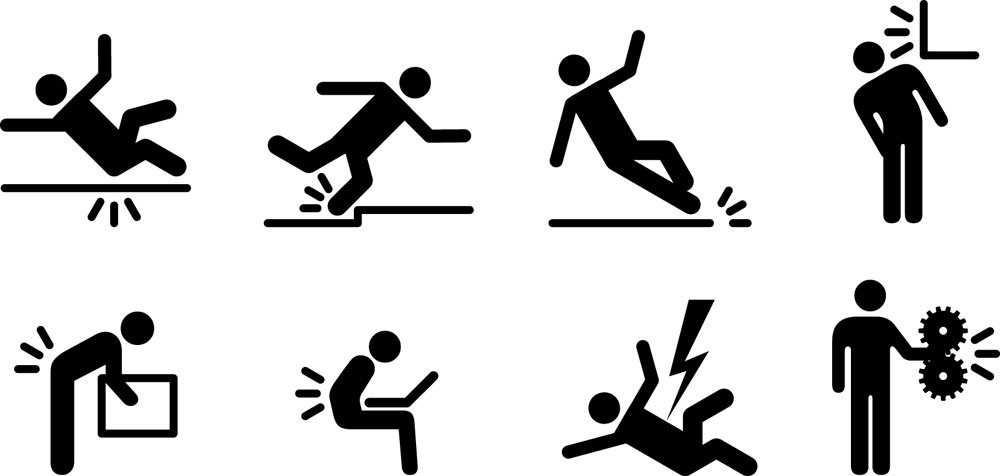

If you investing in high-risk property, you should be taken up the public liability insurance to protect yourself against third party claims or liability due to failure to take proper care in your property. For example, you investing in 5-storey shop office and has a lift which your tenant should take responsibilities as he/she is using it for his/her business. However, if your tenant failed to take good care of the lift or it caused someone get injured, and you will get sued for third party liability as you are the one who own the lift as well as the property.

Ⓑ Protect Yourself From Legal Issues

This is for those property investors who are the only main person to get sued in the event of negligent professional activity or malpractice. Hence, instead of buying the property under your name, you should consider to buying it under your spouse’s name, your children’s name (over 18 years old), family’s property holding company and etc. Do aware of the legal and tax implications before doing it.

Ⓒ Protect Your Own Earning Ability

You must have sufficient coverage for your own house, and buy the insurance that cover of hospitalization, critical illness, death, permanent and temporary disability. The bank usually encourage the borrowers to take Mortgage Reducing Term Assurance (MRTA) to assure their outstanding loans are paid-off if there is any unforeseen happens to them. And the bank is likely to take away your house. Alternatively, you can use your existing insurance policies to protect your beneficiaries in the event of something unforeseen happens to you, and your outstanding loan will be paid-off automatically.

As a property investor, you should aware of the above 3 crisis. You might be able to control over first and second crisis while you can’t predict the 3 crisis happen. Whoever you are, property investor or homeowner, you should plan early for in case of 3 crisis happen to you as your family is innocent, they can’t do much of the property as you are the only one who in-charge for this. You may consult the bank or insurance company to get more details.

It’s not about property ownership it’s about control! To get more details. Click Here!

Like this article or found it helpful? Share it!

Follow us on Twitter for more news, tips and inspiration. Become our mate on Facebook and explore our Pinterest boards.