Although property investment is relatively safe, but, there are still have certain risks existing in the investment method. In order to confirm the positive return that you can earn, it’s always have to understand and manage the possible risks.

The success is always depends on an effective risk mitigation strategy that you need to think about before buying your first investment property.

Ⓐ Slow property appreciation

Although the property value will be double every decade, but this won’t be the case when the times of economic downturn. To lead yourself to successful in property investment field, you may need to have the resources and patience if you are planning for a long term investment. Furthermore, you can also achieve higher levels of property appreciation if you manage to buying an investment property at below market price.

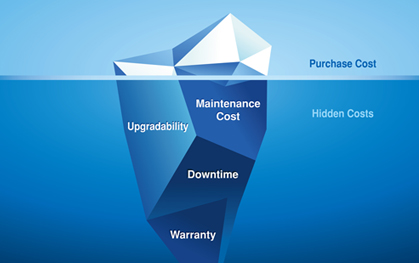

Ⓑ Hidden/ unforeseen costs

If you are manage to investing in rental property, you’ll need to think about the hidden/ unforeseen repair and other costs. Hence, it is important to take out a tenant insurance, in case your tenant fail to pay the rent, but to get full insurance for the property.

Ⓒ No tenants

Yes, this is the first thing that every landlord concerning about. They will worry about no tenants living in their investment property. Even they got the tenants, they still worry about whether the tenants will take care well of their property. If you can’t find the tenant during such long periods, you should consider to lower the rents. Before buying any rental properties, you must practicing your due diligence. For example, where is the rental property in a very high demand.

Ⓓ Learn basic principle of risk management

If you’ve study the basic principles of risk management, you may have the better chances of high returns. If you have got the financial resources, try to design a varied investment portfolio, which is able to enable you to maintain a positive income, even if one of your investment properties isn’t performing as expected.

Furthermore, you may also have to create guaranteed to research your options completely, complete your due diligence, build accurate cash flow projections and buy the property at below market price.

It’s not about property ownership it’s about control! To get more details. Click Here!

Like this article or found it helpful? Share it!

Follow us on Twitter for more news, tips and inspiration. Become our mate on Facebook and explore our Pinterest boards.