Whether you are homeowner or property investor, you should know more about this topic than we do. While, for the newbies on property purchase (first-time housebuyer), this article will be very helpful as you can understand what type of property loans that exist in Malaysia and you can defined which type of property loan that is suitable for your financials. Let’s get started!

① Loan with Fixed Interest rate

This is the common term loan in Malaysia which have a fixed interest rate throughout the loan tenure. This term loan is usually offered by insurance company. This type of loan is extremely useful for the people who purchase the property with the purpose of investment, as they can predict how much profits they can get from that property itself in following years. However, nothing is perfect. The negativity of this loan is inflexible which mean there is no early settlement for repayment allowed.

② Loan with Floating Rate

This term loan is based on a reference rate such as BLR, BFR, OPR and KLIBOR that could change over the duration of the loan tenure. While, this reference rate is controlled by the bank or current market and could be changed at the moment’s notice, it will affect a loan’s interest calculation which means it could affect your monthly repayment amount and loan tenure. Hence, this term loam is quite risky as you will be exposed to changes in the BLR which is beyond your control.

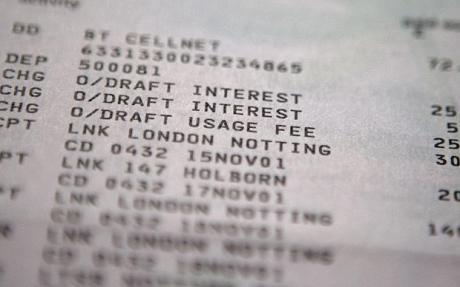

③ Overdrafts (OD)

Overdraft is a line of credit and accessed through a current account with no fixed monthly repayment. Normally, am applicant can only withdraw as much money as he/she has in his account. However, with the facilities of OD, an applicant is able to withdraw the amount that more than the available amount in his/her current account, it is depends on he/she setting the credit limit during the signing process. Do aware that some of the bank will charge a small amount for commitment fee (normally 1% of your un-utilized amount) even if you don’t exploit your line of credit. Hence, make sure you’re fully understand the terms and conditions of its agreement.

④ Combination of Loan and Overdraft

You can get the lower interest costs and enjoy the flexibility at the same time by combination of both loans and overdraft. Let say, your mortgage loan is about RM 100K and you are able to take RM 75K as a loan and the balance of RM 25K will be an overdraft. Besides, how you can do such split is depend on how fast you can clear-off the overdraft portion within the next 2 to 3 years. Let say you can save up to RM 1K every month, then your overdraft portion should be around RM 24K and RM 36K.

Once you have understand the above 4 type of loans then you’re good to go for apply a loan to purchase a property. Remember, always compare the interest rate that offered by different banks and check on which bank offer you a lower interest rate or better loan package that suit to your current financial status.

—WMAPROPERTY

It’s not about property ownership it’s about control! To get more details. Click Here!

Like this article or found it helpful? Share it!

Follow us on Twitter for more news, tips and inspiration. Become our mate on Facebook and explore our Pinterest boards.